With new housebuilding lagging even further behind government targets, this business supplying into major housebuilders still remains well placed to benefit as the UK gets back to work. The shares certainly look good value on several levels as our updated note here reveals.

Background

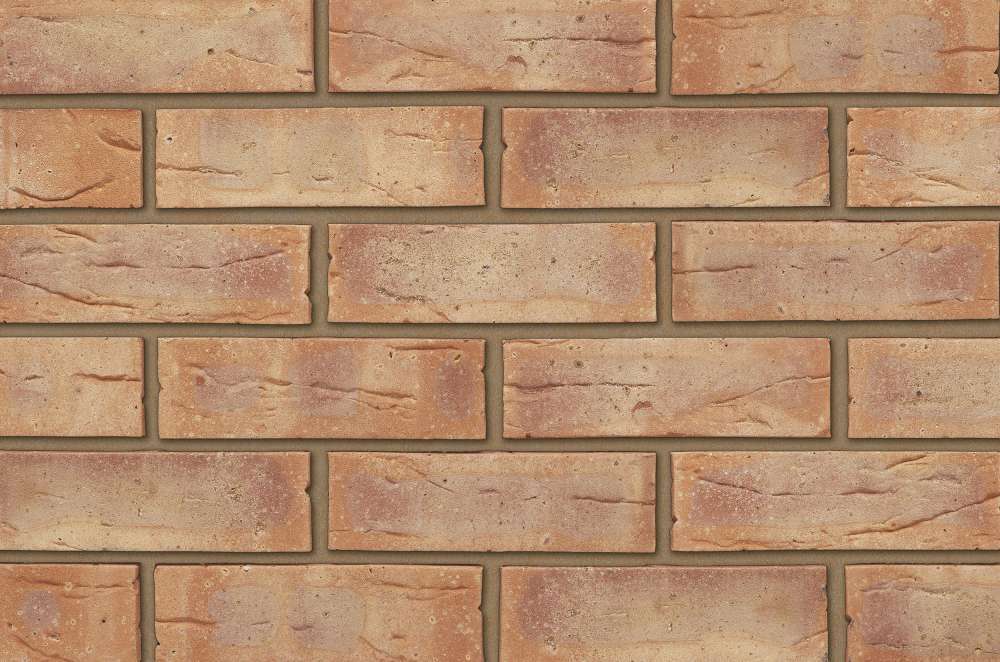

Established in 1984, Brickability Group (LON:BRCK) distributes and installs quality building materials from major UK and European manufacturing partners.

It operates around three core product areas:

Bricks and Building Materials

Heating, Plumbing and Joinery.

Roofing Products and Services

Group revenue ror the year ending March 2019 was £163m

Divisions

Brick and Building Materials Division

Revenue March 2020 year: £143.9m - 77% of group turnover, 54% of EBITDA

The Brick Division is the fastest growing of three leading national specialist suppliers of facing bricks and…

Continue reading our content…

Gain access to all our excellent content for just £90 per year, that’s just 25p per day for financial freedom.

- Unlimited access to our market-beating portfolios

- In-depth coverage of many of the world’s great companies

- Unique insights from our top research team

Register FREE for access to limited content.

- Company and markets insights

- Sponsored content

- Podcasts

Previous article

Next article

More on Brickability

14/05/2024 · Company Insights

Yet another AIM company (and one of our Stonking Small Cap opportunities) is under offer from a…

30/04/2024 · Company Insights

Our coverage here assesses several companies whose shares remain deeply unloved, one of which is one…

More Company Insights

Another AIM company under offer from Private Equity - when will it stop?

April sees another large number of de-listings from AIM

Contrasting experiences in leisure and entertainment

More on Brickability

More Company Insights