XP Power – a tariff busting manufacturing powerhouse

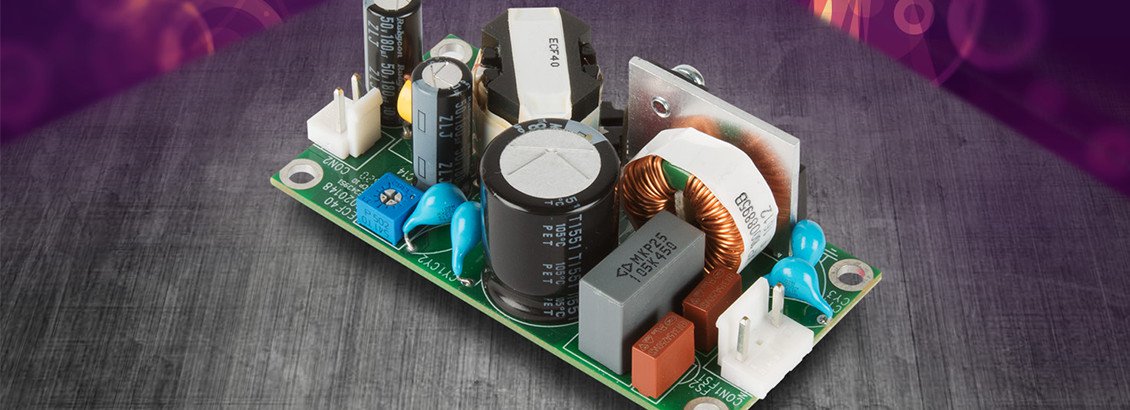

XP Power (LON:XPP) designs power control solutions into the end products of major blue-chip Original Equipment Manufacturers (‘OEMs’).

Our earlier Premium Research commentary here provides an in-depth look into this excellent company.

Results for the year ended 31 December 2018 saw revenue rise 17% to £195m, adjusted pre-tax profit climb 14% to £41.2m and adjusted earnings per share rise 18% to 172.8p. At the current share price of 2030p this equates to an historic price earnings multiple…

Previous article Next article