WPP’s advertised dividend yield could be a winning message

A slowdown in growth has left advertising giant WPP with a 6.9% dividend yield. We explain why this payout still looks safe and could prove to be a winning long-term opportunity for income buyers.

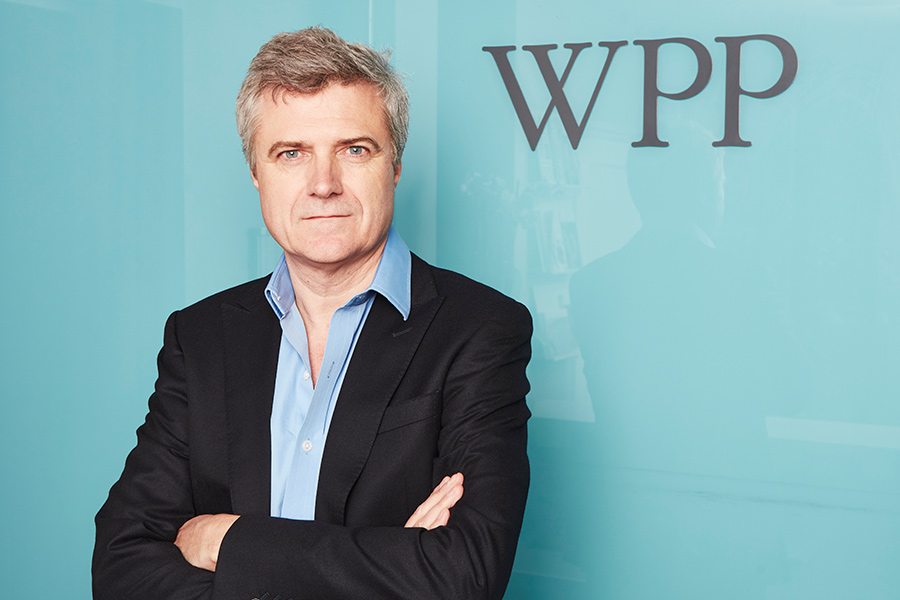

The Income Booster portfolio isn't meant to be a contrarian selection of stocks, our focus is on sustainable dividends and attractive yields. But sometimes value and income overlap. We believe the final stock in this portfolio, FTSE 100 advertising giant WPP (LON: WPP), is just such a firm.

The departure of founder Sir Martin Sorrell in April 2018 proved to be the catalyst for some much-needed change at the firm. WPP's sprawling and fragmented corporate structure…

Previous article Next article